Red Rock Resorts says they “intend to pay quarterly cash dividends” to Class A shareholders “initially equal to $0.10 per share” starting in 3Q16. For an investor buying second-class shares in a company facing stagnant growth and market contraction, dividends are perhaps the only upside. But how likely is it that Red Rock will pay dividends at the promised level? Will it have enough free cash flow to pay dividends? We take a closer look.

Red Rock has a number of obligations that must be met before it can pay dividends to Class A shareholders. The first obligation stems from the indebtedness of Red Rock’s affiliate, Station Casinos LLC. According to Red Rock’s S-1/A filing on April 15, 2016:

The existing debt agreements of Station LLC limit the ability of Station LLC to make distributions to Station Holdco, which effectively restricts the ability of Station Holdco to distribute sufficient funds to permit Red Rock to pay dividends to its stockholders.

On a consolidated basis, Red Rock had total long-term debt of $2.16 billion as of December 31, 2015. The company estimates that in 2016, following the public offering, it will be required to pay $209 million in principal and interest payments on this indebtedness.

The company will also have to spend a significant amount of cash flow on maintenance capital expenditures every year. For 2016, Station Casinos expects to spend “approximately $100 million to $125 million” on capex. From 2013 to 2015, capital expenditures consisted “primarily of various renovation projects at our properties, information technology equipment purchases and slot machine purchases.”

After debt obligations and maintenance capex, Station Casinos or its direct parent Station Holdco can make distributions to its members. We remind you again that Red Rock will have only one-third economic interest in Station Casinos, so any distributions upstream made will primarily go to pre-IPO owners who stay on after the IPO. And these LLC distributions will include payments to cover LLC members’ income taxes.

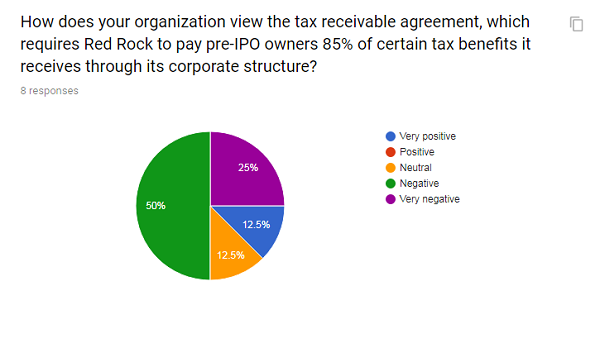

In addition, after Red Rock receives its one-third distributions from Station Casinos, it is required to make payments under the tax receivable agreement (TRA) to pre-IPO owners equal to 85% of its tax benefits. The company estimates it will owe a maximum aggregate payment of $28.1 to $59.0 million under the TRA, although we have seen how TRA liabilities can dramatically increase after an IPO.

For some historical perspective, let’s take a look at Station Casinos’ dividends the last time it was a public company. The following table compares Station Casinos’ historic dividends with Red Rock’s proposed dividends.

Station Casinos, Inc. Dividends vs. Red Rock Resorts Proposed Dividends

| Year |

Annual Dividends |

Prior Year EBITDA

(millions) |

Total Dividend Payments (millions) |

Total Dividend Payments/Prior Year EBITDA |

| 2004 |

$0.69 |

295.2 |

$44.3 |

15.0% |

| 2005 |

$0.92 |

385.4 |

$62.6 |

16.2% |

| 2006 |

$1.08 |

480.9 |

$65.4 |

13.6% |

| Red Rock (proposed) |

$0.40 |

$451.4 (2015) |

$15.4 |

3.4% |

*Station Casinos paid no dividends from 1993-2002 and only two quarterly dividends in 2003.

Red Rock’s proposed 10 cent quarterly dividend at the midpoint of its pricing range ($19.50) equates to around a 2% dividend yield. For those looking for a dividend play, there are plenty of companies with higher dividend yields. Furthermore, Red Rock’s dividend as a percentage of EBITDA is significantly lower than what Station Casinos used to pay out before. Red Rock’s proposed dividend is only 3.4% of 2015 EBITDA, whereas Station Casinos paid an average 15.0% of prior-year EBITDA in dividends from 2004 to 2006.

With questionable prospects for growth and poor corporate governance, investors in the Red Rock IPO might want to look to dividends for a reason to invest in Red Rock. But, as a result of its other obligations, there is no certainty the company will be able to pay dividends at a level that satisfies public shareholders.